On-chain information exhibits the US-based platforms have not too long ago been increasing their Bitcoin holdings. Right here’s what this might imply for BTC’s value.

Bitcoin US To The Relaxation Reserve Ratio Has Been On The Rise Just lately

As defined by CryptoQuant founder and CEO Ki Younger Ju in a brand new post on X, BTC seems to have been shifting from different international locations to American exchanges not too long ago.

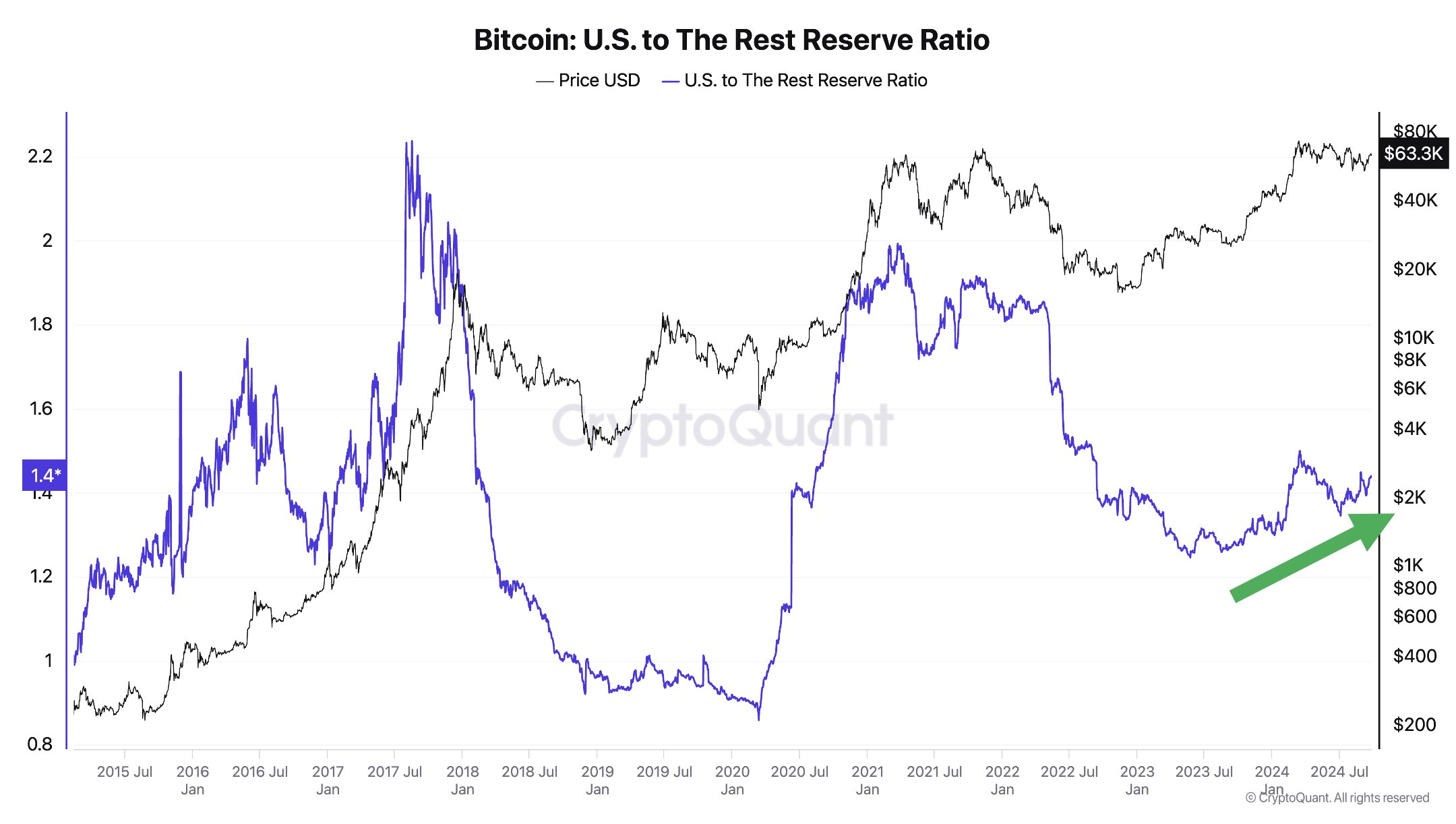

The on-chain metric of curiosity right here is the “US to The Rest Reserve Ratio,” which retains observe of the ratio between the overall quantity of Bitcoin that the US-based central entities like exchanges and funds are holding and that the platforms in the remainder of the world personal.

When the worth of this metric goes up, it means the cryptocurrency is shifting to US-based platforms from these in the remainder of the world. Alternatively, it registering a decline suggests the dominance of the worldwide platforms is rising.

Now, here’s a chart that exhibits the pattern within the Bitcoin US to The Relaxation Reserve Ratio over the previous decade:

The worth of the metric seems to have been driving an uptrend in current months | Supply: @ki_young_ju on X

As displayed within the above graph, the Bitcoin US to The Relaxation Reserve Ratio had noticed a pointy plunge throughout the 2022 bear market and had hit a low in 2023. This might counsel {that a} huge shift within the BTC provide had taken place, with tokens shifting into the wallets connected to offshore platforms.

On this 12 months 2024, nevertheless, the indicator seems to have lastly seen a turnaround, as its worth has been heading up as an alternative, that means that the American platforms are regaining a few of their misplaced dominance.

The primary motive behind this pattern is straightforward: the spot exchange-traded funds (ETFs). The spot ETFs are monetary devices that present publicity to Bitcoin’s value actions by a signifies that’s acquainted to conventional buyers.

These funds lastly gained approval from the US Securities and Alternate Fee (SEC) at first of this 12 months and have since gained some reputation.

The US to The Relaxation Reserve Ratio naturally additionally contains these new funds into its calculation and since they didn’t exist earlier than, it is sensible that its worth would register an uptick after their introduction this 12 months.

Now, what may this uptrend imply for Bitcoin, if something in any respect? From the chart, it’s seen that the final two occasions that BTC noticed a major uptrend within the indicator occurred to coincide with the final two bull runs.

The rally to the worth all-time excessive (ATH) earlier within the 12 months, too, noticed a fast rise within the indicator, albeit its scale was a lot smaller than the expansion noticed within the leadup to the 2017 and 2021 bull runs.

Given the previous priority, it’s potential that Bitcoin might profit from this shift of provide to the American exchanges this time as effectively.

BTC Value

After observing a continuation of its current bullish momentum throughout the previous day, Bitcoin has lastly returned above the $65,000 stage.

Seems to be like the worth of the coin has been on the rise for some time now | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com