Fast Take

One of the persistent misconceptions about Bitcoin is the idea that mining harms the surroundings. Whereas it’s true that Bitcoin mining requires substantial vitality, this vitality consumption is essential for sustaining the community’s safety. Current information from Pierre Rochard, VP of Analysis at Riot Platforms, offers invaluable insights into the evolving panorama of Bitcoin mining, notably in Texas.

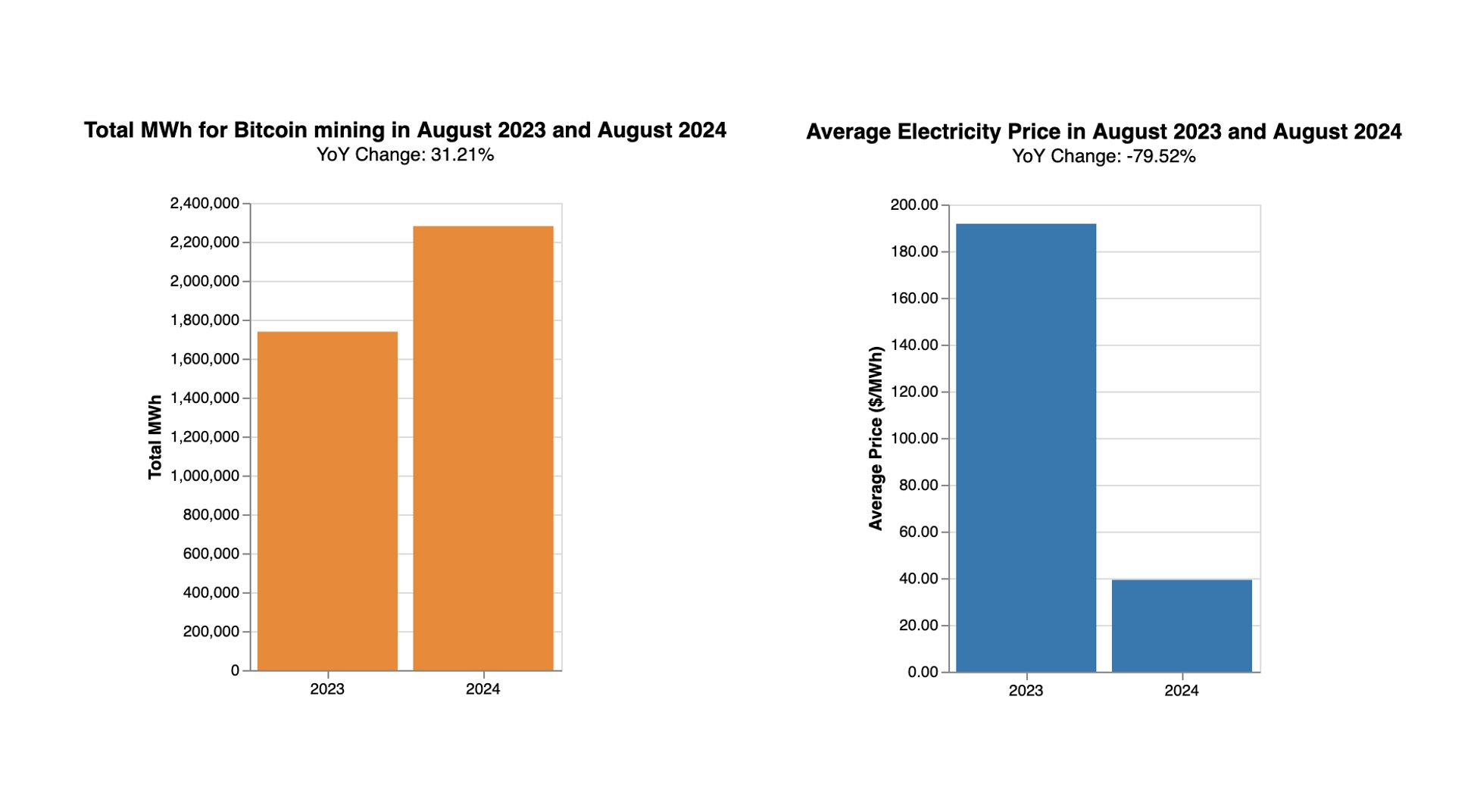

In accordance with Rochard’s evaluation, there was a big 31% year-over-year enhance in Bitcoin mining vitality consumption in Texas, rising from 1.7 million MWh in August 2023 to 2.3 million MWh in August 2024. Curiously, this enhance in vitality utilization has coincided with a outstanding 80% lower in electrical energy costs, from $190 per MWh to simply $40 per MWh. This decline in vitality prices is partly attributed to the distinctive position that Bitcoin miners play in stabilizing vitality grids.

Rochard believes that electrical energy costs soar primarily as a result of elevated air-con use, for instance, throughout excessive warmth, as seen final summer season. Bitcoin miners, due to this fact, typically curtail utilization to deal with consuming elevated electrical energy throughout off-peak instances when demand and costs are decrease.

Riot Platforms highlights in an article that Bitcoin miners’ flexibility in energy utilization helps steadiness vitality grids, guaranteeing stability whereas securing dependable, predictable energy at decrease prices.

“In contrast to conventional information facilities, Bitcoin miners can simply alter their energy utilization, making them best for balancing vitality grids. They supply regular demand throughout low-use intervals and reduce when energy is in excessive demand, guaranteeing a easy, environment friendly grid”.

During times of low vitality demand, miners present a gradual demand, and when vitality demand spikes, they will reduce their utilization. This flexibility ensures a extra environment friendly and secure grid and offers miners with dependable energy at predictable costs.

For the vitality grid, having Bitcoin miners as constant, long-term clients reduces demand and worth volatility, encouraging extra competitors and reducing general vitality charges. This symbiotic relationship between Bitcoin mining and the vitality grid presents a compelling case for the optimistic impression of Bitcoin on vitality markets.