Key Takeaways

- Qatar’s new digital belongings framework covers tokenization and good contracts.

- Over 20 startups have joined the QFC Digital Belongings Lab for crypto product improvement.

Share this text

The Qatar Monetary Centre (QFC) has released a complete regulatory framework for digital belongings, establishing clear guidelines for crypto actions within the area. The “QFC Digital Belongings Framework 2024” supplies a authorized and regulatory basis for numerous points of the crypto business.

The brand new framework, introduced on Sunday, covers a variety of digital asset actions together with tokenization, property rights in tokens, custody preparations, switch and alternate. It additionally supplies authorized recognition for good contracts, aiming to foster belief and confidence amongst customers, service suppliers, and business stakeholders.

QFC officers emphasised the framework’s excessive requirements for asset tokenization processes and the institution of a trusted know-how infrastructure. The rules had been developed after intensive session with an advisory group comprised of 37 home and worldwide organizations, reflecting a collaborative method to crypto governance.

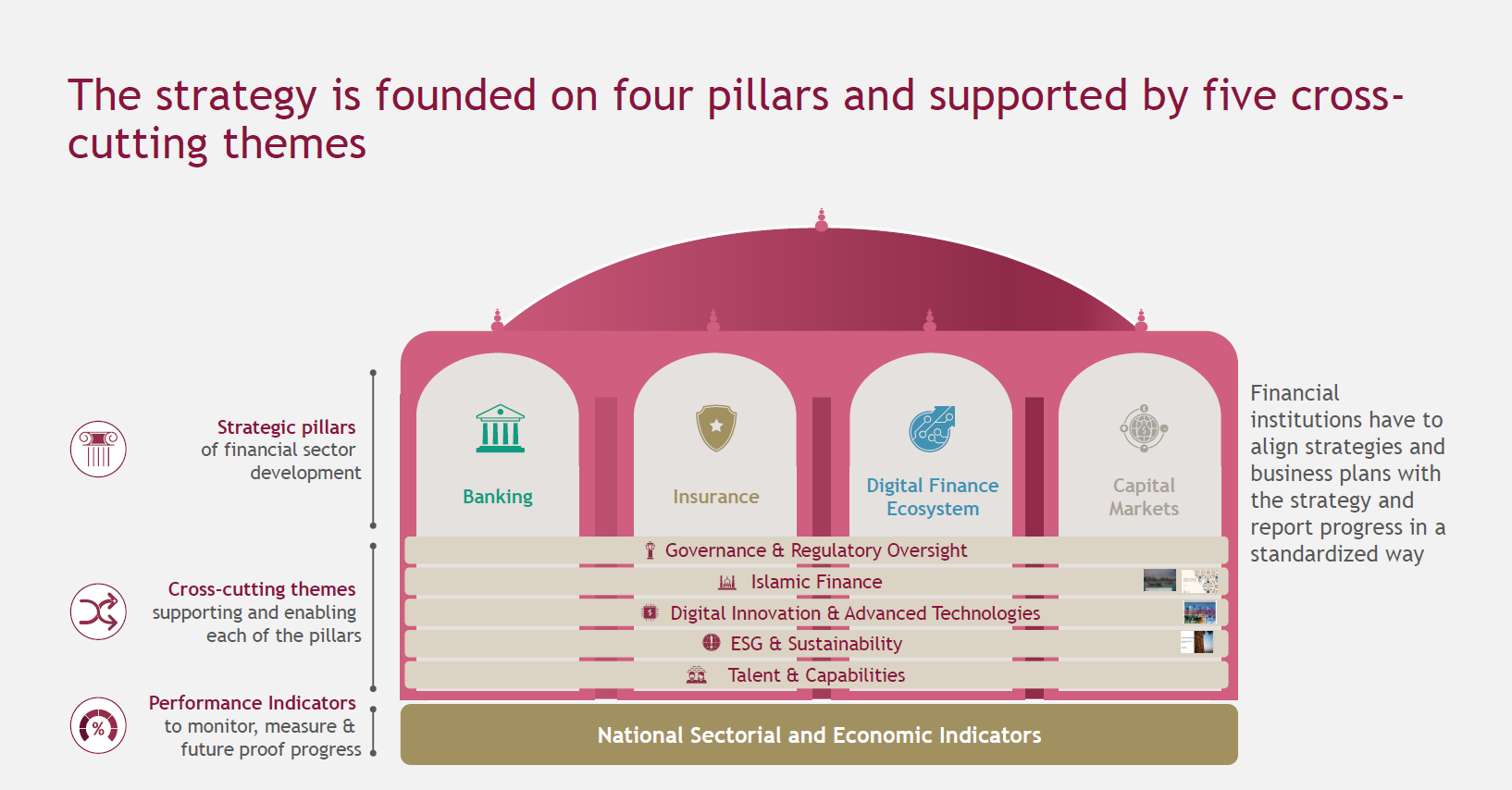

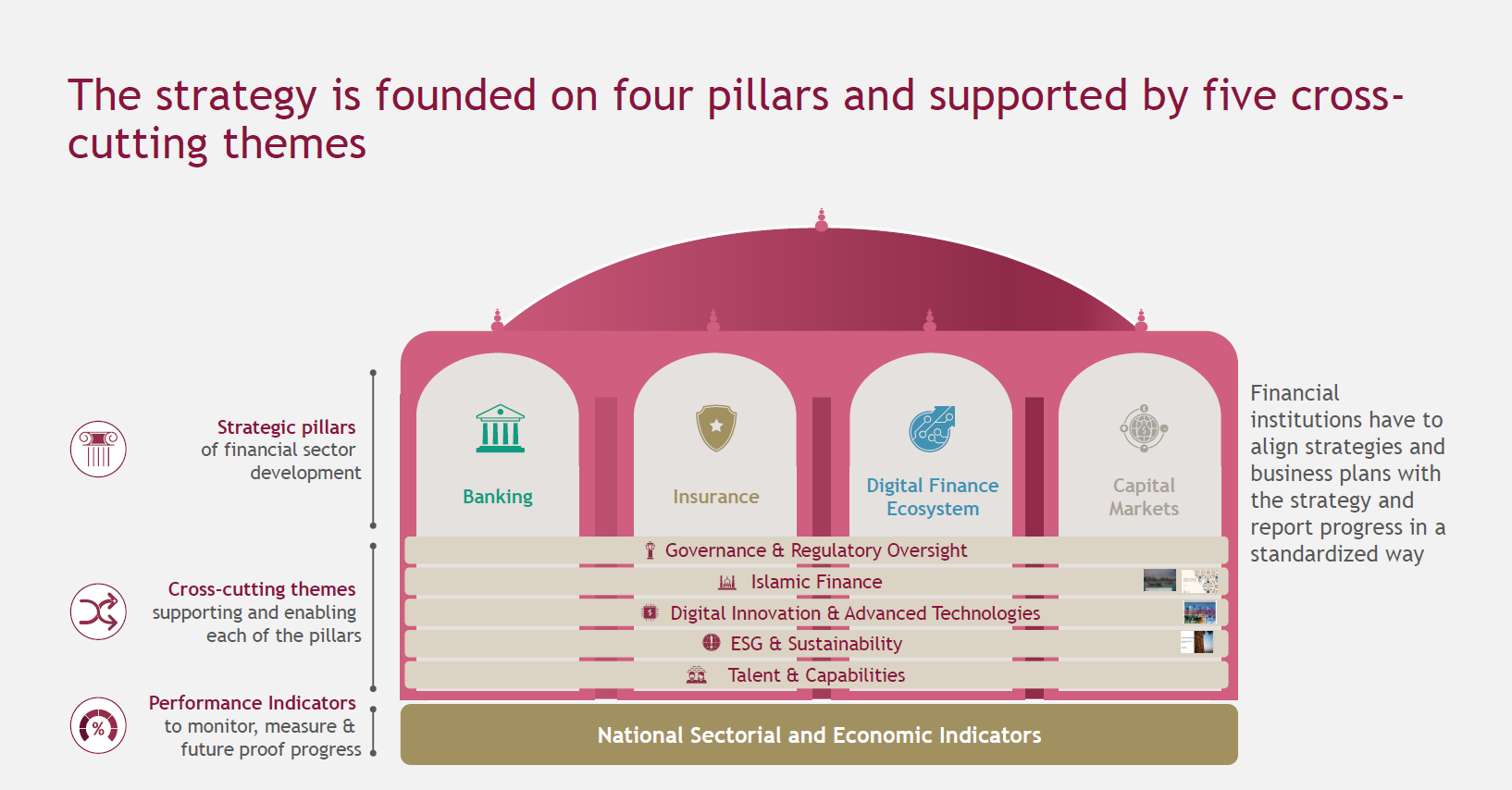

Third Monetary Sector Technique

This regulatory initiative is a part of Qatar’s broader “Third Financial Sector Strategy,” which goals to place the nation as a regional chief in monetary innovation.

By offering clear pointers, the QFC seeks to draw crypto companies and promote the expansion of the digital asset sector inside its jurisdiction.

Along side the brand new rules, the QFC has been actively supporting crypto innovation by its Digital Belongings Lab, launched in October 2023. Over 20 startups and fintech corporations have been accepted into this program to develop and commercialize their crypto asset merchandise, demonstrating Qatar’s dedication to nurturing blockchain know-how and digital finance.

The QFC, an onshore enterprise and monetary heart in Doha, gives a novel working surroundings for corporations. Its particular standing permits for 100% overseas possession and full revenue repatriation, with a aggressive 10% company tax price on domestically sourced income.

This business-friendly ecosystem, mixed with the brand new digital asset rules, positions Qatar as a beautiful vacation spot for crypto corporations.

With the launch of the Digital Belongings Framework, the QFC has opened functions for corporations searching for licenses to function as token service suppliers. This transfer is predicted to draw a various vary of crypto companies to Qatar, doubtlessly establishing the nation as a major hub for digital asset actions within the Center East.

Qatar’s introduction of a complete digital asset framework displays the rising international development of jurisdictions growing specialised rules for the crypto business. By offering regulatory readability, the QFC goals to stability innovation with shopper safety and market integrity, addressing key issues which have hindered widespread crypto adoption in lots of areas.

Geopolitical conflicts and secure haven flows

The implementation of those rules might have far-reaching implications for the crypto sector within the Center East, regardless of ongoing complications and conflicts in the region which have triggered slides throughout crypto markets. An evaluation from Kaiko Analysis coated by Crypto Briefing means that Bitcoin has failed to draw “safe haven” investment flows because the Center East disaster escalates.

With Qatar positioning itself as a crypto-friendly jurisdiction, it might affect neighboring international locations to develop related frameworks, doubtlessly resulting in elevated regional competitors in attracting crypto and digital asset companies and investments.

Share this text