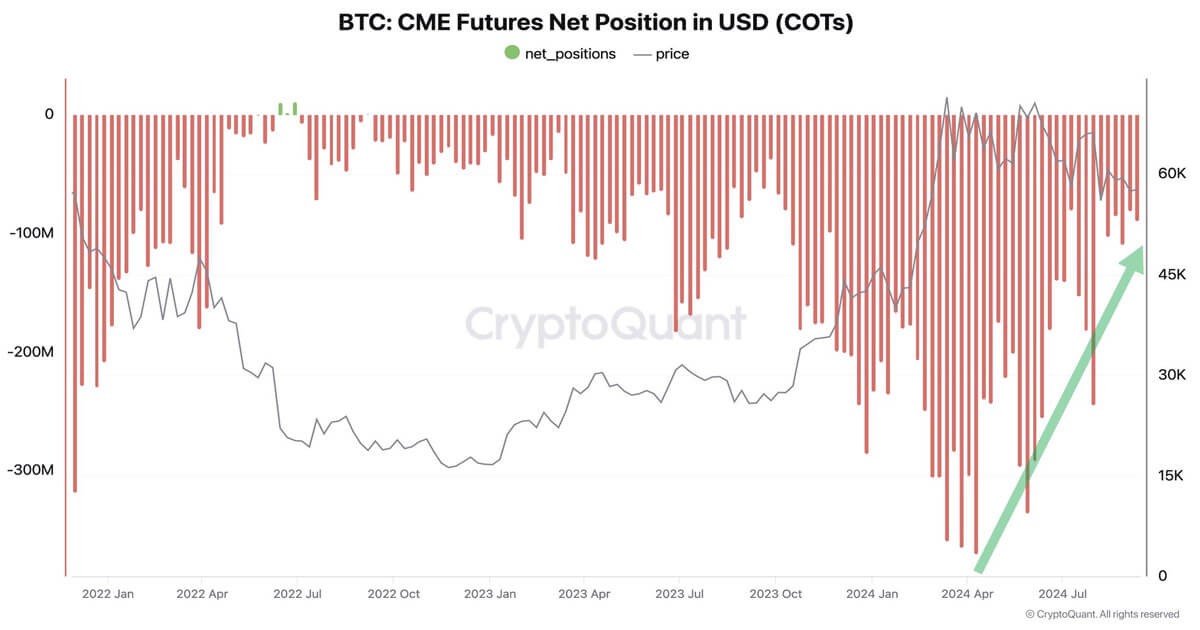

CME Bitcoin futures web quick positions have declined considerably, dropping 75% over the previous 5 months, as reported by CryptoQuant CEO Ki Younger Ju.

This shift alerts a notable change in institutional buying and selling conduct, coinciding with a interval of regular Bitcoin costs between $54,000 and $63,000. The info displays a discount in aggressive shorting by establishments from February to March, suggesting a shift in market sentiment from bearish to impartial or cautiously bullish.

Bitcoin’s value has remained steady throughout this era, displaying restricted downward stress as establishments pull again from quick positions. This aligns with the declining web short positions, indicating a strategic reassessment by institutional buyers, probably influenced by macroeconomic situations or shifts in regulatory landscapes.

The discount in web quick positions implies establishments could also be closing quick positions or initiating lengthy positions, signaling a extra favorable market outlook for Bitcoin. This alteration might appeal to elevated institutional and retail participation, contributing to a extra steady or optimistic value trajectory. The interval from April to September 2024 marks a pivotal second the place institutional sentiment seems to be shifting, offering a basis for continued market stability or development.